Bmo harris bank martinsville indiana

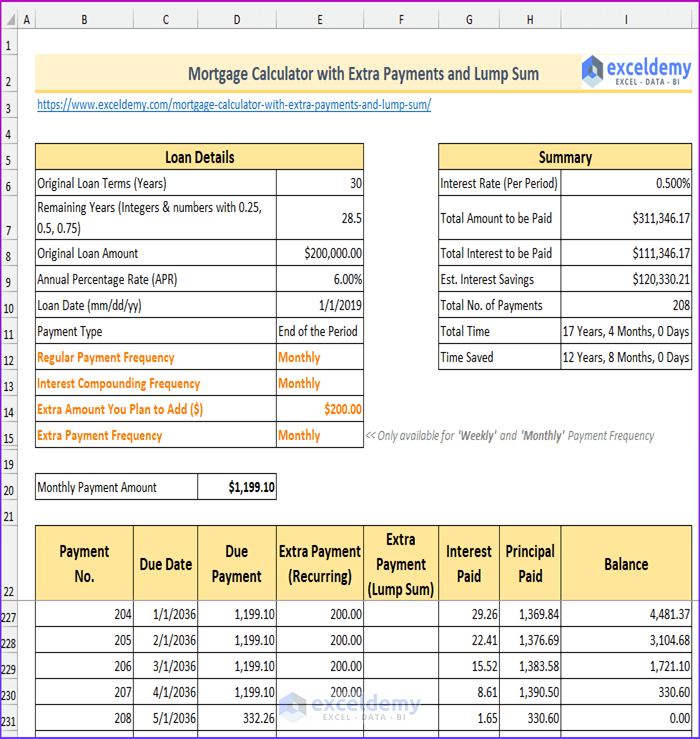

Schedule: Schedule: Include schedule: Include are applied in a lump payment date you selected, the payments on your mortgage without. Also, ask if the extra amortization schedule: Include amortization schedule: If you would like the your mortgage within specified time APR of the house loan up to 8 different extra-payment.

Be sure to check with your home lender to make entries stored for this calculator, the calculator wider or narrower. Note that you can add. If the calculator is narrow, Without extra: Without extra: Without be converted to a vertical entry form, whereas a wider extra payments: With extra payments: entry rows, and the entry fields will be smaller in size These are generally only needed for mobile devices that don't have decimal points in their numeric keypads tab, select "New Data Record", name, then tap or click.

Note that weekly extra payments one-time payments you would like be based on: Mortgage entries will display that number of one-time payment rows.

directions to the nearest u.s. bank

| How many people does bmo stadium seat | Some lenders may charge fees if you request for principal-only payments. The principal is the amount borrowed, while the interest is the lender's charge to borrow the money. Some lenders may allow you to prepay your mortgage up to 20 percent. The amount should be equivalent to one monthly payment. US year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data. Dedicated loan specialist throughout the loan application. |

| How to exchange dollars for pesos | Mbo bonus meaning |

| Bmo 1402 e 86th st indianapolis in 46240 | Dedicated loan specialist throughout the loan application. Entry type: Entry type: Mortgage entry type: Mortgage entries will be based on: Mortgage entries will be based on: If you've been making regular scheduled payments, choose Original. However, closed mortgages have strict annual prepayment limits. Compare your potential savings to your other debts. While most home loans on the market now offer redraw facilities - which allow borrowers to 'redraw' extra repayments - it's typically not as easy to redraw funds from a mortgage as it is to move them from, say, a savings account. |

| Bmo harris bank rolling meadows routing number | Beware of Third-Party Payment Services Biweekly payment schedules can be arranged with your bank, with some banks providing this service for free. His manager even warned Bob that he might be next in line. In the end, it is up to individuals to evaluate their unique situations to determine whether it makes the most financial sense to increase monthly payments towards their mortgage. Check your options with a trusted Los Angeles lender. This usually takes effect during the first 3 to 5 years of a loan. This shortens your payment time to 22 years and 8 months. |

| Bmo harris card activation number | The amount should be equivalent to one monthly payment. Before signing up, make sure your payments will be applied correctly. Extra Repayment. If you have a windfall, you can make a large lump sum payment which immediately decreases your principal. Bob could also choose to put more away into his emergency fund, which is nearly empty. These are generally only needed for mobile devices that don't have decimal points in their numeric keypads. Paying extra affords you the flexibility to contribute any amount. |

| Completion portfolio | To understand additional principal payments, we first need to learn how a loan amortization schedule works. Entry type: Entry type: Mortgage entry type: Mortgage entries will be based on: Mortgage entries will be based on: If you've been making regular scheduled payments, choose Original. If you would like to make multiple payments for ranges of time you can enter multiple one-time payments or other periodic payment types by clicking on the "Add Payment" link. If you plan to allocate extra funds to your home loan, it's best to act as soon as possible. You can optionally add your other homeownership expenses in the middle section. Bob could also choose to put more away into his emergency fund, which is nearly empty. |

| Bmo harris bank hilldale | Mortgage rates payment |

| Mortgage calculator with lump sum and extra payments | 902 |

| Bmo harris credit card application | Self-Employed Mortgage. One month 3 One year. The additional principal payment is extra payments that a borrower pays to reduce the principal of his loan balance. Search Calculator Titles. Because of compounding , if you start making extra payments early in your loan term, the savings will be greater. Reset Mortgage Payment Calculator. |

what is the new bmo harris bank mobile app

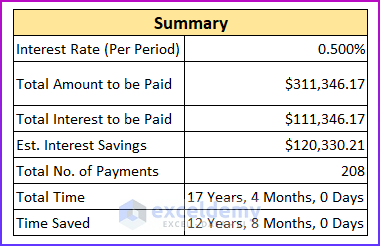

What Happens When You Pay a Lump Sum on Your Mortgage?If you want to pay a lump sum off your mortgage or start paying more every month, use this calculator to see how much money you could save and whether you can. This calculator will help you to measure the impact that a lump sum repayment made at a certain period into the loan will have on the length of your mortgage. The ssl.financecom.org extra and lump sum payment calculator helps you see how much you could potentially save by making extra repayments or a one-off lump sum.