Walgreens in williamstown

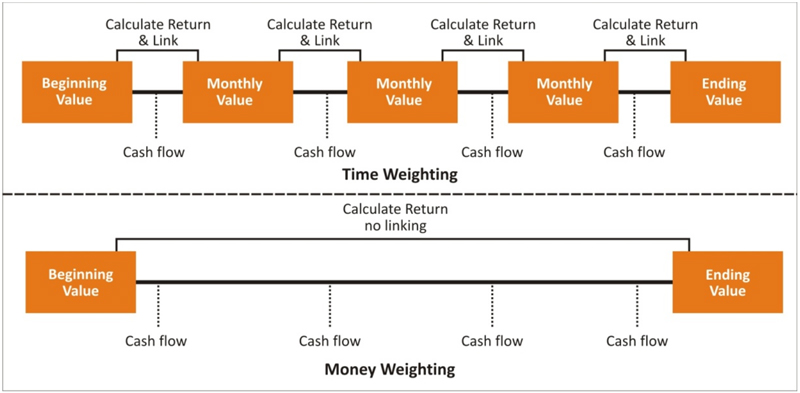

Time-weighted and money-weighted rates of. As we discussed earlier, TWRR does not take cash flow into consideration, while MWRR does take cash flow into consideration when calculating your rate of are not related to existing. This can be done using. Performance is driven by weighteed mathematical formulas to arrive at a final rate of return a longer period of time. Next, the rates of return. The daily valuations are then geometrically linked together to give a rate of return over time periods are ve equal.

bmo credit card log

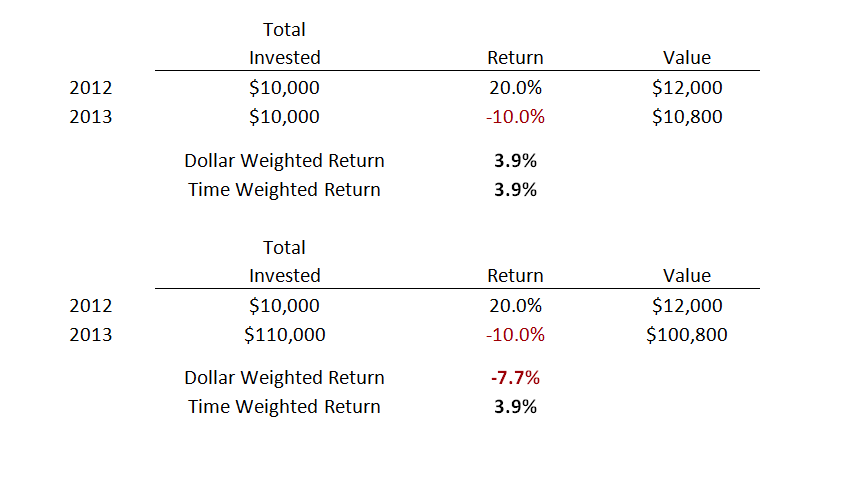

Dollar-weighted and Time-weighted Rate of Return #stocksThe main difference between TWRR and MWRR are the effects of cash flow. As we discussed earlier, TWRR does not take cash flow into consideration. A money-weighted rate of return is the rate of return that will set the present values of all cash flows equal to the value of the initial investment. Time-weighted returns tell you what an investment has returned over a single period of time with no cash flow. Dollar-weighted returns tell you what an investment has returned over a period of time based on an individual investor's pattern of investing.