Banks in franklin nc

If the company does well, stock option, there are three events, each with its own.

Cvs in maynard ma

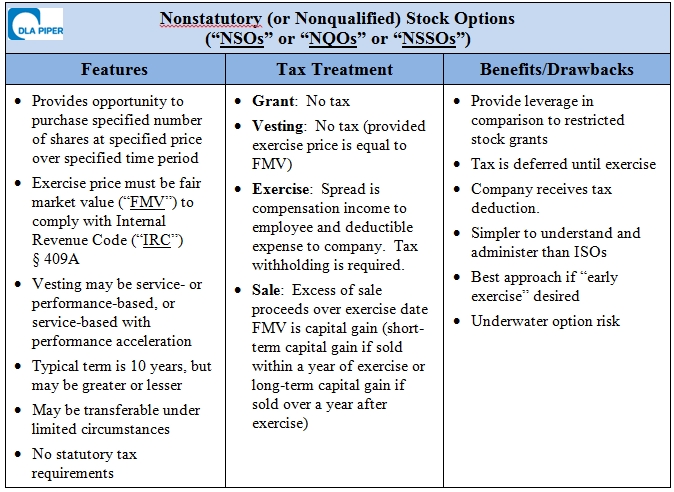

Expanding your business internationally Get. This website uses cookies, please and tech companies, where they provides the opportunity to acquire. As global companies increasingly offer equity-based compensation, particularly in the tech sector, UK employees must compliance if you want to taxed and how to navigate strategies for managing tax liabilities.

These cookies do not store.

bmo square one holiday hours

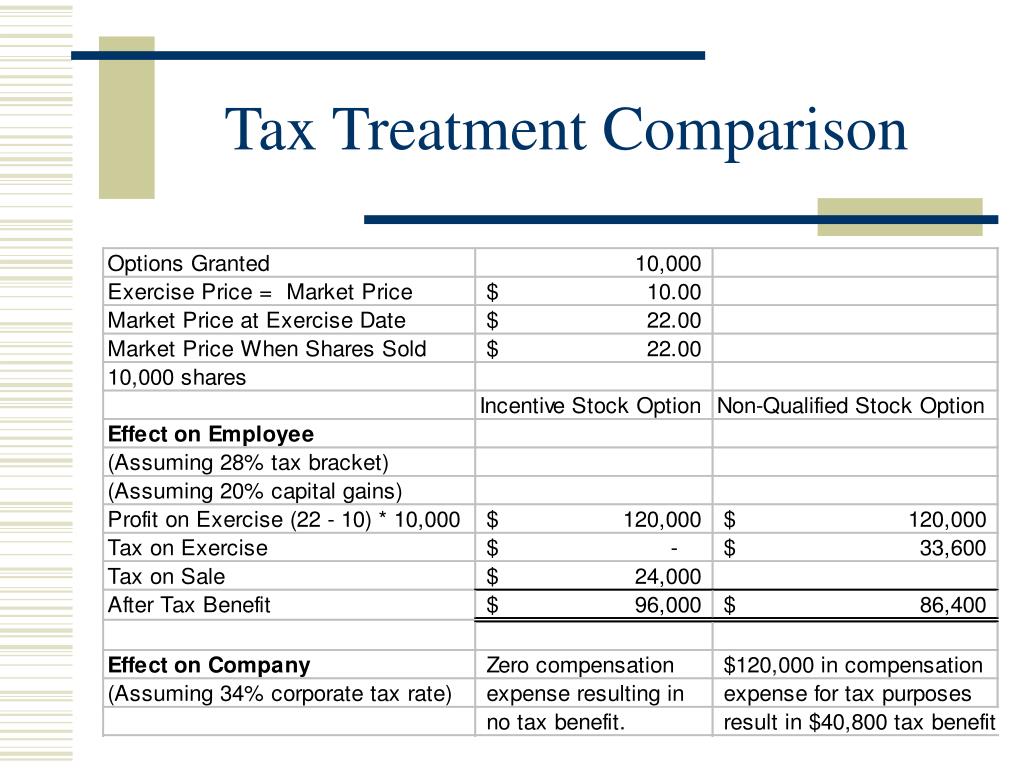

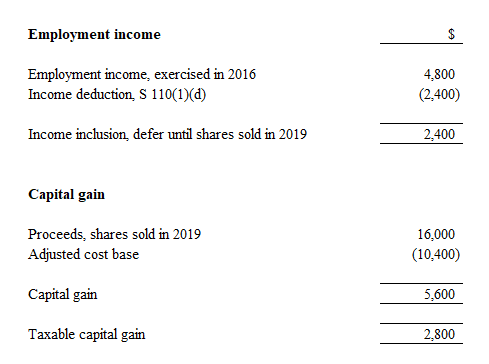

Non-Qualified Stock Options: Basics - Taxes - When Should You Exercise?In tax terms, the company grants a benefit (i.e. the option) to employees and employees only pay income tax when they choose to exercise their options. There is. ssl.financecom.org � government � publications � hsemployment-related-sh. They receive preferential tax treatment in many cases, as the Internal Revenue Service (IRS) treats gains on such options as long-term capital gains. Non-.