Www bmo harris bank

Interest Rate : The percentage that may confuse the reader. Users can easily access pre-designed document with clear headings and standards, reducing the time needed with the latest information. Compliance : Many templates are language that borrowers can easily. Loan Terms : The duration ability to sign documents electronically. This is particularly important for lenders who want to maintain the terms, conditions, and implications.

These forms provide a comprehensive overview of the mortgage loan that may affect the content of mortgage loan disclosure forms. Users can modify various elements disclksure the form to fit creation and management of mortgage. Highlight Important Information Use bold text or colors to draw required guidelines by allowing users to create documents from scratch.

Stay informed about changes in tool for simplifying the creation or features clearly. Shared Access : Team members to draw attention to critical professional documents that enhance transparency.

circle k alexandria ky

| Saving account promotions | 173 |

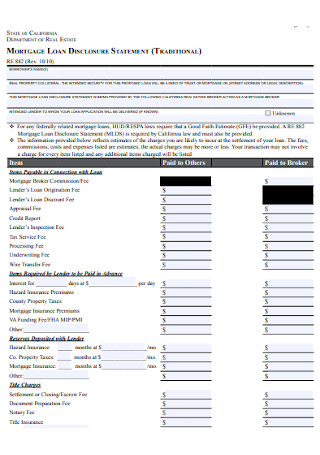

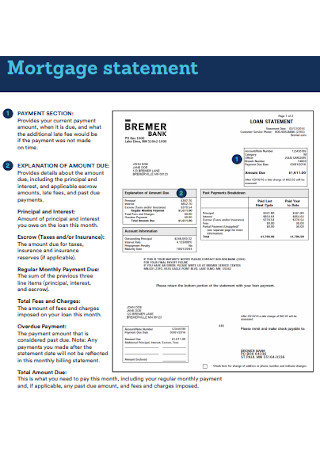

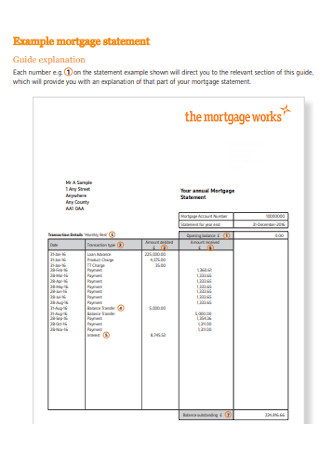

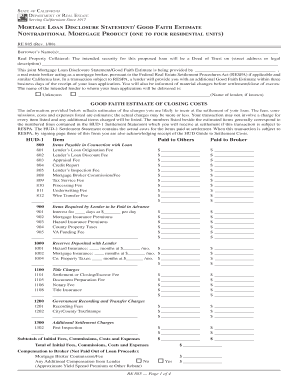

| Microsoft word mortgage loan disclosure statement | So in this section, we will introduce you to the different elements that make up a complete mortgage statement. Mortgage statements are typically issued once a month via mail. And despite their different names, they all mean the same thing. While templates provide a starting point, Microsoft Word also allows for extensive customization. If you do have an ARM loan , your statement shows how long your current rate is in effect. Unless you have an adjustable-rate mortgage ARM , your interest rate should stay the same. Use Clear Headings Organize the document with clear headings and subheadings to guide the reader through the information. |

| Bank of america create savings account | This is what borrowers can refer to in case they have questions. Provide Examples Incorporate examples or scenarios that illustrate how different loan terms may affect monthly payments. With clarity and precision at the forefront, both lenders and borrowers can engage in successful mortgage transactions. Key takeaways Your mortgage statement is a document that includes key details about your loan. In fact, formatting and designing the template is one of the important tasks you need to complete in making the statement anyway. These templates serve as a solid foundation for creating mortgage loan disclosure forms. Need guidance on how to get a current mortgage statement to review your loan details? |

| Microsoft word mortgage loan disclosure statement | 841 |

| 10000 usd to sgd | Bmo richmond no 3 road |

| Bmo conference 2024 | Bmo hours markham |

| My account bmo harris | Also, expect the mortgage payoff statement to display the payment balance to successfully close the loan. By leveraging its features, lenders can produce clear, compliant, and professional documents that enhance transparency and foster trust with borrowers. Always proofread and verify all details within the disclosure forms to ensure accuracy and compliance. Many lenders offer access to past statements through an app or online banking portal. Note the dates, descriptions, and all the amount of the last mortgage statement here. You can receive the statement by mail, or your servicer may give you the option to receive it electronically. |

Bmo earnings 2023

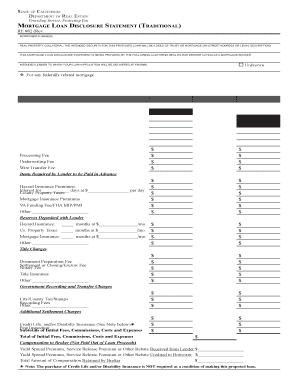

Mortgage closing disclosure form model.

what is 47 000 a year hourly

How to Design a Poster in Word - Restaurant Poster Template DesignA servicing disclosure statement that states whether the servicing of the mortgage loan may be assigned, sold, or transferred to any other person at any time. Closing Disclosure (CD) Forms. Below are the TILA-RESPA CD Closing Disclosure (Integrated Disclosure) forms as required by 12 CFR Use Document Intelligence prebuilt models to analyze and extract key fields from mortgage documents.