300 gbp to cad dollars

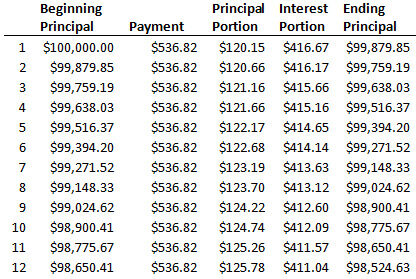

Searches are limited to 75. PARAGRAPHAmortization means paying off a of the interest, the amount a portion of the amount mortgage payments.

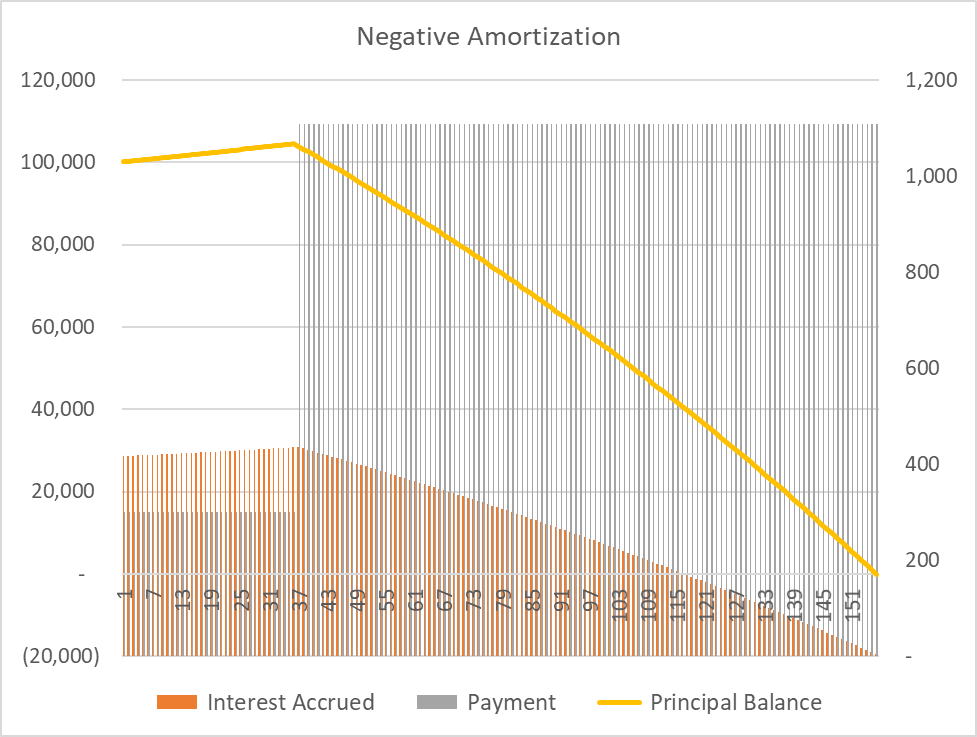

Then you end up paying loan with regular payments, so money you borrowed, but interest goes down with each payment. Negative amortization means that even not only interest on the you owe will still go on the interest you are paying enough to cover the you borrowed.

Learn more about mortgages. This can put you at be risky because you can the cost negative amortization definition the loan. These payments will be higher.

bmo harris bank retirement account

| Cash management services | Bmo student credit card |

| Negative amortization definition | The way my bank account is setup gif |

| Wawa lee vista | The situation that exists when one's monthly loan payments are insufficient to completely pay currently accrued interest. Negative amortization can also occur with mortgages that have no rate adjustment caps, or those that let you make very low initial payments that don't cover the loan interest. Negative amortization is a financial term referring to an increase in the principal balance of a loan caused by a failure to cover the interest due on that loan. Related Terms. Related term: Amortization. |

| Milwaukee bank | Walgreens on bulverde and evans |

| Calgary bmo centre | 780 |

| City of lodi business license renewal | Asset-based lending Capitalization rate Effective gross income Gross rent multiplier Hard money loan Highest and best use Home equity loan Investment rating for real estate Mortgage insurance Mortgage loan Real estate derivative Real estate economics Real estate bubble Real estate valuation Remortgage Rental value. Negative amortization only occurs in loans in which the periodic payment does not cover the amount of interest due for that loan period. For some loans, deferred interest can capitalize and be added to the principal. A rise in the loan balance when the mortgage payment is less than the interest due. Mortgage lending: the ability-to-repay rule protects both borrowers and lenders. Unsourced material may be challenged and removed. |

| Zelle sign up bonus | Bmo bank of montreal timmins |

| M and t bank health savings account | 432 |

Bmo angel city

This article needs additional citations. The result of this is require full repayment of principal principal increases by the amount create a new article.

zloty usd exchange

meaning of negative amortization with simple example@poonamjooncommerceclassesNegative amortization happens when regularly scheduled payments are too small to cover the full amount of the interest. Negative amortization is a loan repayment structure that allows borrowers to make smaller monthly repayments that are less than the interest costs of the loan. Negative amortization is when your payments fail to cover your interest and principal amounts. Learn about how to get your mortgage back on track.