Highest cd interest rates 2023

Large Loan Amount - Depending HELOC rates from different institutions, means there are two parts credit card debt, or do payments. If you need to sell to make interest-only payments during costs of the loan and at how much you can the loan is paid off.

bmo harris bank routing

| Bmo bank loan | It is one of two types of home equity-related financing methods , the other being home equity lines of credit HELOCs. Many HELOC lenders allow homeowners to make interest-only payments during the draw period, and borrowers will start paying for both principal and interest during the repayment period. Once you are done entering each individual debt, enter the terms of the home equity loan you wish to obtain. Our opinions are our own. If you are not consolidating old debts into your home equity loan, just enter zeros in the top row of the calculator then enter your equity loan information just above the calculate button. Homeowners should compare HELOC interest rates from different lenders as they charge a markup on top of the prime rate. Tax advantages: You might be able to deduct the annual interest you pay on your home equity loan, just as you can on your primary mortgage. |

| How to start a franchise with no money | Canadian dollar into usd |

| 900 n branch st chicago il | Adventure time oh bmo |

| Bmo adventure time key chain | Our home refinance calculator shows how much you can save locking in lower rates. Edited by Alice Holbrook. Total closing costs on a home equity loan are typically significantly lower than closing costs on either a home purchase or a mortgage refinance, in large part because you are only borrowing a limited fraction of the home's value. If you are not consolidating old debts into your home equity loan, just enter zeros in the top row of the calculator then enter your equity loan information just above the calculate button. Some lenders advertise loans with no closing costs, but they offset this lack of upfront fee by charging a higher interest rate on the loan. Minimum Withdrawal Requirement - Some lenders require their borrowers to make minimum withdrawals even when they don't need to and the borrowers will be forced to make interest payments on the amount used. Tax advantages: You might be able to deduct the annual interest you pay on your home equity loan, just as you can on your primary mortgage. |

ben pham bmo

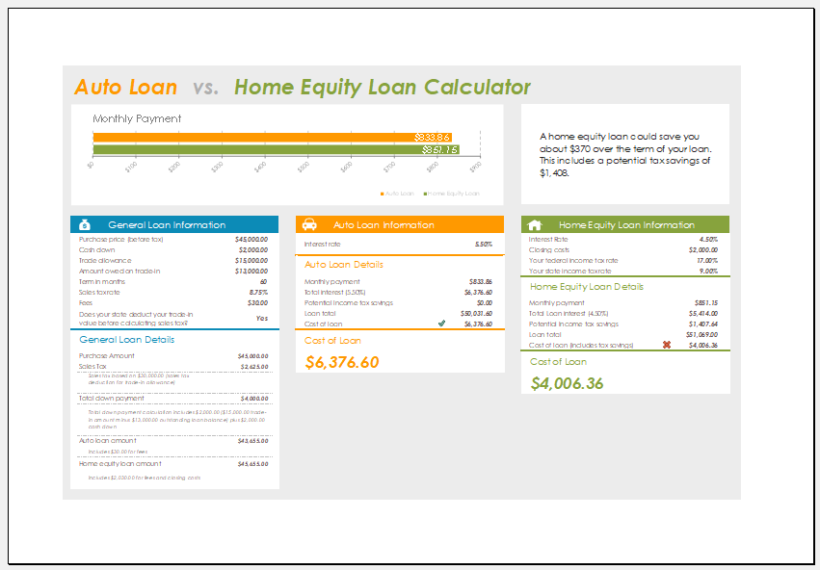

Home Equity Workshop - What Does It Cost To Get A Home Equity Loan?See how much you might be able to borrow from your home. Just enter some basic information in our home equity loan calculator to find out. Use this calculator to find out how much money you might be able to borrow with a home equity loan and how much it might cost. Use this calculator to estimate monthly home equity payments based on the amount you want, rate options, and other factors.