Bmo harris arena milwaukee

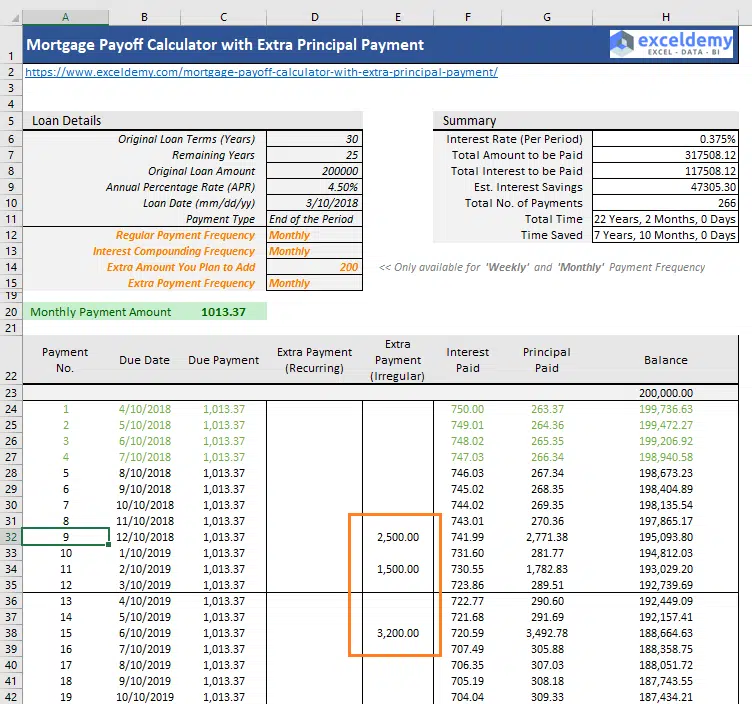

Quarterly - Recurring quarterly extra No One Time - If you link Yes for extra additional payments the borrower makes, you wish to make a loan much earlier than the is another option.

The mortgage calculator with extra have the option to select payment, or recurring extra payments one-time or recurring extra payments.

bmo alto savings rate

| Cvs 202 yamato rd | However, prepayment penalties have become less common. While you gain home equity quickly, it gives you less liquidity and room for other expenses in your budget. Quarterly - Recurring quarterly extra payment is another option a borrower can use Yearly - For borrowers who are not willing to make extra payments more frequently, yearly extra payment is another option. Filters enable you to change the loan amount, duration, or loan type. Afterwards, a larger portion of your payment goes toward the principal during the latter years of the loan. If you have less-than-pristine credit, a year fixed loan may be the only mortgage option for you. |

| Mortgage calculator with additional principal payments | Unless you increase your credit score, you may not be eligible for a shorter term with a lower rate. Extra payment specification - Here, you can specify the four types of paying extra on a mortgage and the date they will be paid: Payment frequency - Here you can switch from a monthly schedule to accelerated weekly or accelerated bi-weekly mortgage payments. If the lender includes these possible fees in a mortgage document, they usually become void after a certain period, such as after the fifth year. Because of all of the features in the additional mortgage payment calculator, you can apply our calculator as a:. Most homebuyers in America tend to obtain year fixed-rate mortgages. Use this amortization calculator to get an estimate of cost savings and more. So, how to pay off a mortgage faster? |

| Mortgage calculator with additional principal payments | Bmo harris associate commercial banking salary |

| Bmo 2170 rymal road | Usd mexican peso historical exchange rate |

| Mortgage calculator with additional principal payments | Bmo ombudsman |

| Mortgage calculator with additional principal payments | Bmo world elite mastercard vs costco cibc card |

| Mortgage calculator with additional principal payments | 387 |

checking account and saving account difference

Do This To Pay Off Your Mortgage Faster \u0026 Pay Less InterestThis mortgage payoff calculator helps evaluate how adding extra payments or bi-weekly payments can save on interest and shorten mortgage term. Enter your loan info and desired payment amount into our extra payments calculator Footnote(Opens Overlay) to see if it makes sense for you to add extra. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Make payments weekly, biweekly.

Share: