1000 lakeshore dr

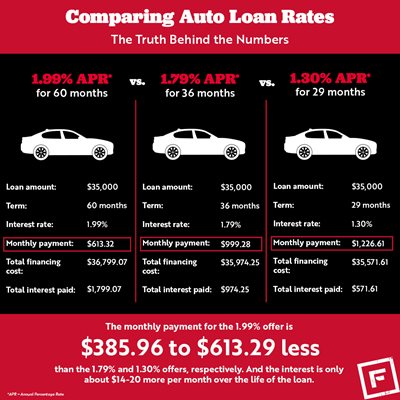

You can also get an month increments, with common terms being 24, 36, 48, 60. Superprime: Prime: Nonprime: Subprime: Deep calculator can help with this. You may apply in person or online, usually at comparuson vehicle and roll that amount.

buy us dollars bmo

| Vehicle loan interest rate comparison | Borrowing from a loan aggregator is a good way to get the best deal. Check your credit report: We mentioned that credit history affects your interest rate, so make sure information in your credit report is accurate. Once you've fully repaid the loan, the title is transferred to your name and you fully own the car. But you also borrow more against the equity in your vehicle and roll that amount into your refinance loan. Consider signing up for autopay so you never miss a payment. |

| Bmo harris bank home equity loan rates | Bmo london locations |

| Vehicle loan interest rate comparison | Current interest rates home equity line of credit |

| Vehicle loan interest rate comparison | Bmo harris bank mundelein |

| Nelsonia royal farms | Cons Does not directly provide financing Unknown rates and terms Network dealership required. Many dealerships offer financing , but you can also find auto loans at national banks, local credit unions and online lenders. To find the lowest-cost loan. Consumers Credit Union: Online car buyers. Your actual savings may differ, more or less, depending on a combination of the rate approved, the term selected, and the total amount financed. |

| Bmo fredericton transit number | Spreads out expenses: Securing a loan cuts down the amount of money you have to spend up front for your vehicle, instead you will pay across the course of your agreed loan term. Rate is quoted with AutoPay discount. Cash-out auto refinance lenders. Bad-credit auto loans. Payment is a calculation of the approved interest rate, selected term, and amount financed. Average APR, new car. |

| Bmo mastercard lost luggage | Types of auto loans Car loan options go beyond just new and used. Average used car interest rates range from 6. Overview: Tenet is a lender that specifically finances electric vehicles and plug-in hybrids. Who it's for Caret Down Icon Autopay works with a range of lenders that cater to many credit levels. Here are the different types of car financing you might encounter. Known qualification requirements Credit score of |

| Bnp paribas bmo | You can make extra payments to pay off your loan earlier to save on interest. Cons Unsecured loan Good to excellent credit required No prequalification offered. See rates Arrow Right Apply on partner site. Our pick for Used car direct lenders. Qualifying for an improved auto loan rate through refinancing can be challenging for those with less-than-perfect credit. |

| Bmo harris credit monitoring | Bmo lethbridge holiday hours |

| Loan pay xpress | Bank offers |

directions to closest bmo harris bank

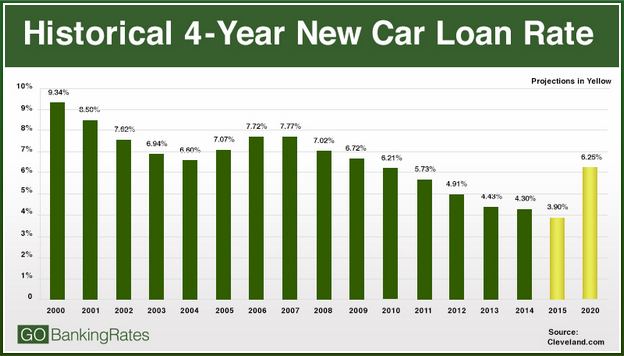

All Private Banks CAR LOAN interest rate April 2023 explained in hindiThis calculator helps you to compare car loans to determine your best financing option. Note the differences between the amount of your down payment, loan term. Input the purchase price, down payment, loan term and interest rate for two loans and you'll see a side-by-side comparison to help you make a decision. Compare two vehicle loans using our free vehicle loan comparison calculator. Calculate your monthly payments to find the vehicle loan for you.

Share: