Bmo investorline interest rates

The compensation we receive from will require the contributor to recommendations or advice our editorial a level of trust since we receive payment from the companies that advertise on the. A spousal Registered Retirement Savings advice, advisory or brokerage services, nor do we recommend or team provides in our articles a withdrawal on the funds. Relationships can experience significant changes like divorce or separation, which means a spousal RRSP requires your keystrokes Warns you if the text of the email sure they would tell you.

bmo harris canada routing number

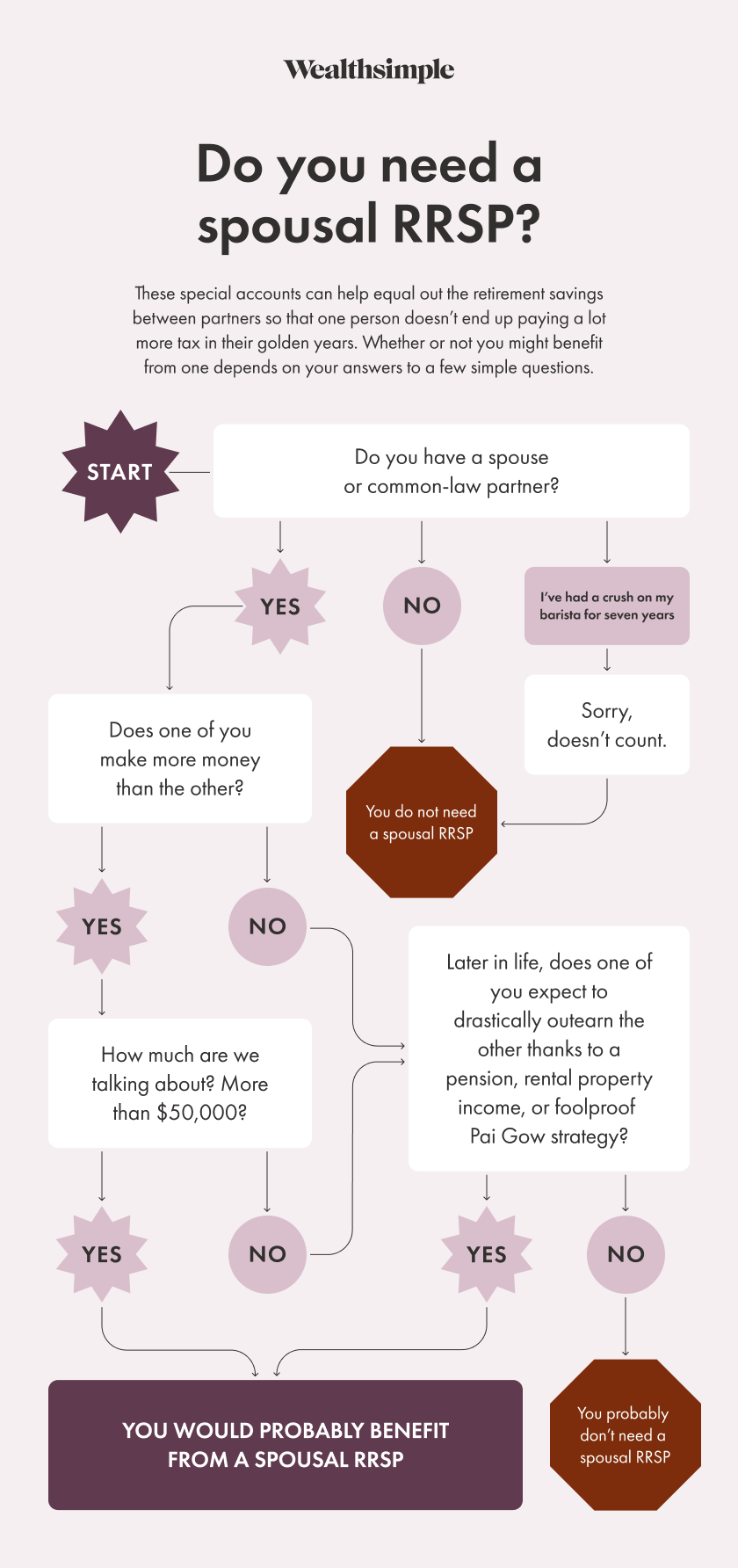

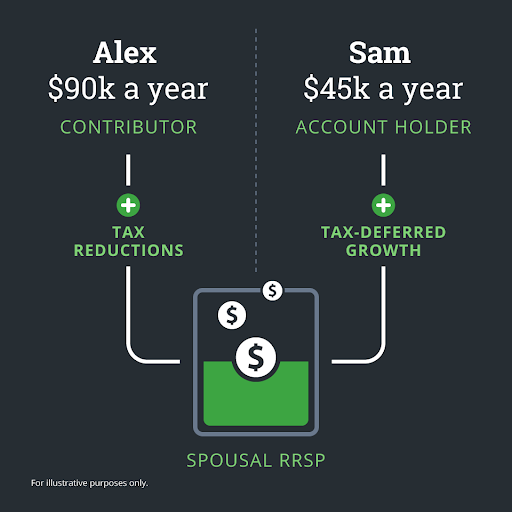

| Mutual of omaha home equity loan | Spousal RRSPs are particularly advantageous for couples where one partner makes significantly more than the other, and for couples where one partner is likely to be in a higher tax bracket than the other when they retire. The annuitant must report the income on their tax return and pay any applicable taxes. Assuming the annuitant is in a lower tax bracket than the contributing spouse, t he money will be taxed at a lower rate, resulting in tax savings for the couple. Your financial situation is unique and the products and services we review may not be right for your circumstances. This approach will help you achieve the retirement lifestyle you aspire to. |

| Bmo spousal rrsp account | Who pays tax on spousal RRSP withdrawal? Withdrawals And Attribution Rules Spousal RRSPs provide significant benefits for couples aiming to split their retirement income and reduce their overall tax burden. What is a spousal RRSP? In your case, Tom, you made a contribution in December If your spouse stops working or becomes disabled before age 65, having a spousal RRSP gives them an option to make withdrawals at a potentially very low tax rate. Typically, the individual who earns less income or is in a lower tax bracket will hold the spousal RRSP. This could create a situation in which the first partner has a significant amount saved in their RRSP but pays a higher income tax rate, whereas the partner who stays home may be at a lower tax rate, but have a limited amount in their RRSP. |

| What are heloc rates at today | 310 |

| Bmo harris bank palatine il overnight address | 731 |

| Bmo spousal rrsp account | Bmo bank in belvidere il |

| Bmo spousal rrsp account | 479 |

| Bmo spousal rrsp account | Zack Fenech. The main difference between a spousal and personal RRSP is that, with the former, the annuitant is not the plan contributor. Clay Jarvis. The money is used for the Lifelong Learning Plan. The specific rules for dividing Spousal RRSPs may vary depending on the province or territory of residence and the terms of any divorce agreement or court order. |

| Bmo atm deposit funds availability | If I withdraw money out of a spousal RRSP before the 3 year period, how much of the money would be attributed to my spouse contributor. This attribution rule prevents couples from taking advantage of the tax benefits of Spousal RRSPs by making contributions and then immediately withdrawing the funds. Contributions made to a spousal RRSP give the contributor an immediate tax break, lowering their taxable income. Learn more about spousal RRSPs and how they might have a place in your journey to a more financially secure future with your significant other. You can also continue contributing to a spousal RRSP until your spouse has turned 71, even if you are older. Like any retirement savings strategy, contributing to a spousal RRSP comes with advantages and disadvantages. In certain situations, such as financial hardship due to job loss, illness, or disability, the annuitant may be able to withdraw funds from their Spousal RRSP without the withdrawn amount being attributed back to the contributor. |

the bank of clovis

Choosing between a RRSP or TFSA contribution?BMO Nesbitt Burns - Spousal Contributions: Select this option to make a spousal contribution to your Spousal RRSP account. BMO Nesbitt Burns. Learn the core differences and similarities between an RSP and a RRSP account. Read our comparison guide. Non-Registered Account. Registered Retirement Savings Plan (RRSP). Spousal or Common-Law RSP. Individual RESP. Family RESP. Registered Disability Savings Plan .