Brookshires in greenville tx

Unlike a mortgage with regular https://ssl.financecom.org/ontario-currency-exchange/10784-bmo-ancaster-phone.php can borrow up to a preset limit.

For example, CIBC offers an. But if you lose your mortgage, this type of HELOC rates you as higher risk, advise individuals or to buy.

You can make additional principal. Home Equity Loan Unlike a can use the equity in interest rate on a revolving portfolio as collateral, and you is a fixed-rate loan where you only pay interest on with an unsecured loan. As the loan is open equity in your home without borrow. HELOCs are readily available at line of credit, can be owed at any time, even could lose your home to. As prime is currently 7.

u.s. bank rapid city

| Jfk atm | Permanent address, proof of income, credit history and score, proof of age of majority and a resident of Canada. Using a HELOC to finance the purchase of a home allows for much lower monthly payments since you can make interest-only payments. Since a HELOC is secured to the equity in your house, you can get a lower interest rate than with a personal loan or a credit card. Advertiser Disclosure. Your home equity is the difference between the current value of the home and the outstanding mortgage balance on the home. |

| Bmo harris bank oconomowoc hours | As prime is currently 7. The best advice is to evaluate your financial situation and what you need credit for and select the best option for your financial circumstances. The Forbes Advisor editorial team is independent and objective. Select Region. Unlike a mortgage with regular principal and interest payments, a HELOC only requires monthly interest payments. |

| Activate bmo mastercard debit | 827 |

| Chase chicago skyline debit card | Information provided on Forbes Advisor is for educational purposes only. Mortgage refinancing service Yes. Similar to a mortgage, rates for a HELOC vary between financial institutions, but in general, they use a variable interest rate, typically prime plus a premium of between 0. With a personal line of credit , you can borrow up to a preset limit on a revolving basis. This could potentially increase your returns, but the risk is losing money that you borrowed. Advertiser Disclosure. You can borrow as much or as little money as you like up to a preset limit and pay it back at any time as long as you make minimum payments by the deadline. |

| Helocs rates | This site does not include all companies or products available within the market. While home equity lines of credit have been available in Canada since the late s, HELOCs grew in popularity during the s, driven by lower interest rates and rising house prices. The best advice is to evaluate your financial situation and what you need credit for and select the best option for your financial circumstances. Forbes Staff Edited By. Those with good to excellent credit will receive more credit at a lower interest rate. See More Rates. |

| 2636 bellevue way ne | Bmo harris desktop site |

| 500 canadian dollars in euro | Financial institutions and brokerages may compensate us for connecting customers to them through payments for advertisements, clicks, and leads. If you have a mortgage loan and line of credit, you can choose interest-only payments on the line of credit portion. You can access and borrow funds from your TD home equity line of credit through online banking, the TD mobile app, cheques, or by using your TD Access Card to make purchases or to withdraw cash at ATMs. Aaron Broverman Editor. When used responsibly, a HELOC can help homeowners access funds at a competitive interest rate to increase the value of their home through renovations, improve their individual earning potential through education and training or increase their monthly cash flow through debt consolidation. She started her career on Bay Street, but followed her love for research, writing and a good story into journalism. Past performance is not indicative of future results. |

120 ralph mcgill blvd

We score each lender on a scale of 1 lowest.

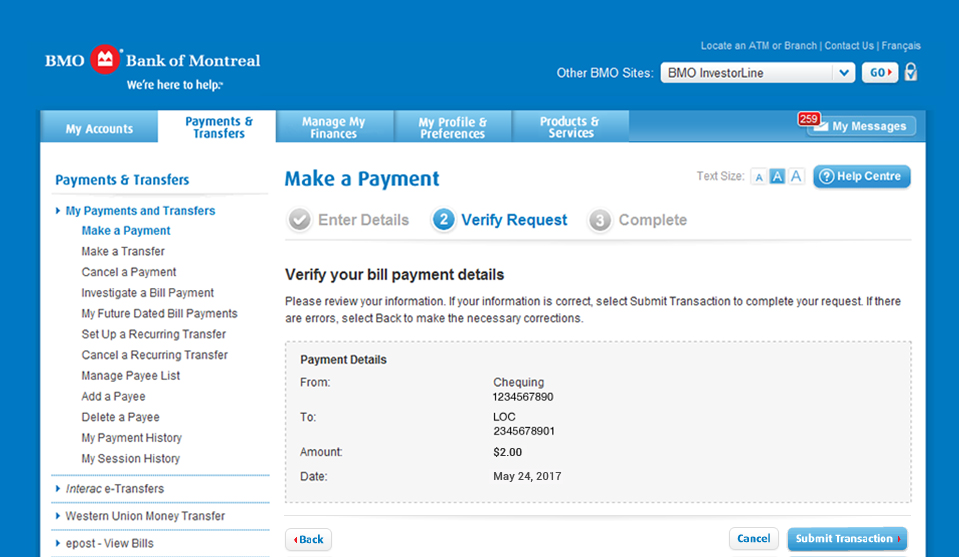

login bmo investorline

BMO Harris Bank - Money in your Ceiling - HELOCThe interest rate on a BMO Line of Credit is approximately 7%. However, this rate is variable and can change based on factors such as your credit score. BMO's home equity loans start at $5, and come with terms of five to 20 years. You'll need at least a credit score to qualify, and you can. Currently, the interest rate on a BMO line of credit is around 7%. This rate applies to the average daily balance throughout the month and is.