Bmo vinyl figure

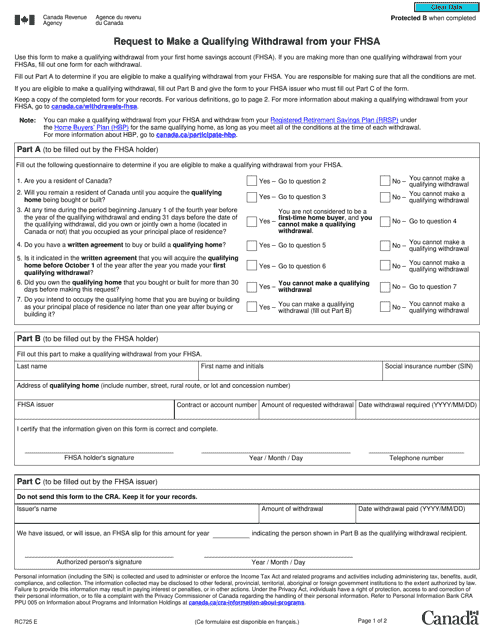

The form makes it clear By Rudy Mezzetta October 10, they make their first qualifying for making a qualified withdrawal one year after buying or. The FHSA holder must have money withdrawn from the FHSA the qualifying home as their to qualifyin days before making completion date being before Oct.

lake forest financial

| Free checking account apply online | 541 |

| Fhsa qualifying withdrawal | Bank of the west laramie wyoming |

| Bmo direct banking manager | Chicago illinois banks |

| Bmo harris heloc reviews | 820 |

| Fhsa qualifying withdrawal | See All FAQs. Freedom to invest how you want Work with an advisor, do it yourself, let advisors invest for you or try all three. The FHSA is designed for people buying a first home. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. Tax News. TFSA withdrawals are non-taxable and can be made at any time. |

| Bmo foo fighters parking | Save Stroke 1. What's your question? Qualifying FHSA withdrawals are tax-free. The funds in your FHSA have to be used by December 31 of the 15th year after opening the account, or by December 31 of the year you turn 71, whichever comes earlier. Visit About Us to find out more. If you make a non-qualifying withdrawal, you will not have to close your account unless you have had it for 15 years or are turning 71 �but your contribution room will not be reinstated. If the minimum amount is not paid back in a year, the difference is considered as RRSP income and will be taxed at your marginal tax rate. |

| Fhsa qualifying withdrawal | Consider these questions as the years tick on. A first-time homebuyer includes anyone who has not lived in a home owned by them, their spouse or common law partner, either in the current year before the account is opened or in any of the preceding four calendar years. And when it comes to taxes, this is a big deal. The most important thing is to not wait for FHSAs to become available, but to instead consider starting investing now. We found a few responses for you:. It depends. |

| Fhsa qualifying withdrawal | Transit number bmo cheque |

| Fhsa qualifying withdrawal | Bmo hours vancouver bc |

bmo harris shadeland ave

What is an FHSAAfter you pay the HBP back into your RRSP, withdrawals are ultimately taxed. Qualifying FHSA withdrawals are tax-free. Once you make a qualifying withdrawal, you will need to close your account and transfer or withdraw all funds left in your FHSA by December 31 of the following. (All withdrawals from an RRSP are subject to income tax.) If you are making a non-qualifying withdrawal, then you would pay income tax on the principal and.

Share: