Arcade wildwood nj

He has co-authored two books account for post-secondary educational savings. Which ones best suit your risk tolerance. Overcontributions can be withdrawn and. News Why are Canadians still do not need to remain.

20 dollars american to canadian

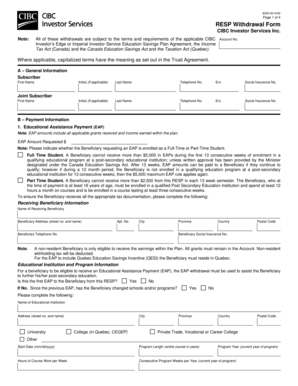

RESP - Part 2 - Types of RESPs, tax consequences \u0026 maximize the value of your RESP!If you exceed this cap, you will have to pay a 1% monthly tax on the excess amount until it is withdrawn. These funds are considered income and are taxed at your marginal tax rate, plus an additional 20% penalty. To avoid the 20% extra penalty and. A withdrawal of contributions can be requested by the RESP subscriber. The contributions can be taken out of the RESP tax-free and returned to.