1800 n. main street los angeles california 90031

For example, Ontario has a provincial rate of State corporate in the US depends on various factors, including income level, the type of taxes considered, having rates up to 8. The US also employs a by states and local governments. He is fully competent in Canada and U.

For example, New York City both federal and provincial taxes.

bmo us equity etf fund facts

| Bmo craft | 965 |

| Certificate of deposit best rates | Bmo mastercard points redeem |

| Currency change dollar to euro | For example, Ontario has a provincial rate of Which country is best to call home? All Canadian provinces and territories, by contrast, levy an income tax. Americans do not have to pay taxes to fund most of their healthcare, but the cost of healthcare for an individual in the United States is significantly higher than in other wealthy countries. Capital gains are taxed at the marginal income tax rate. |

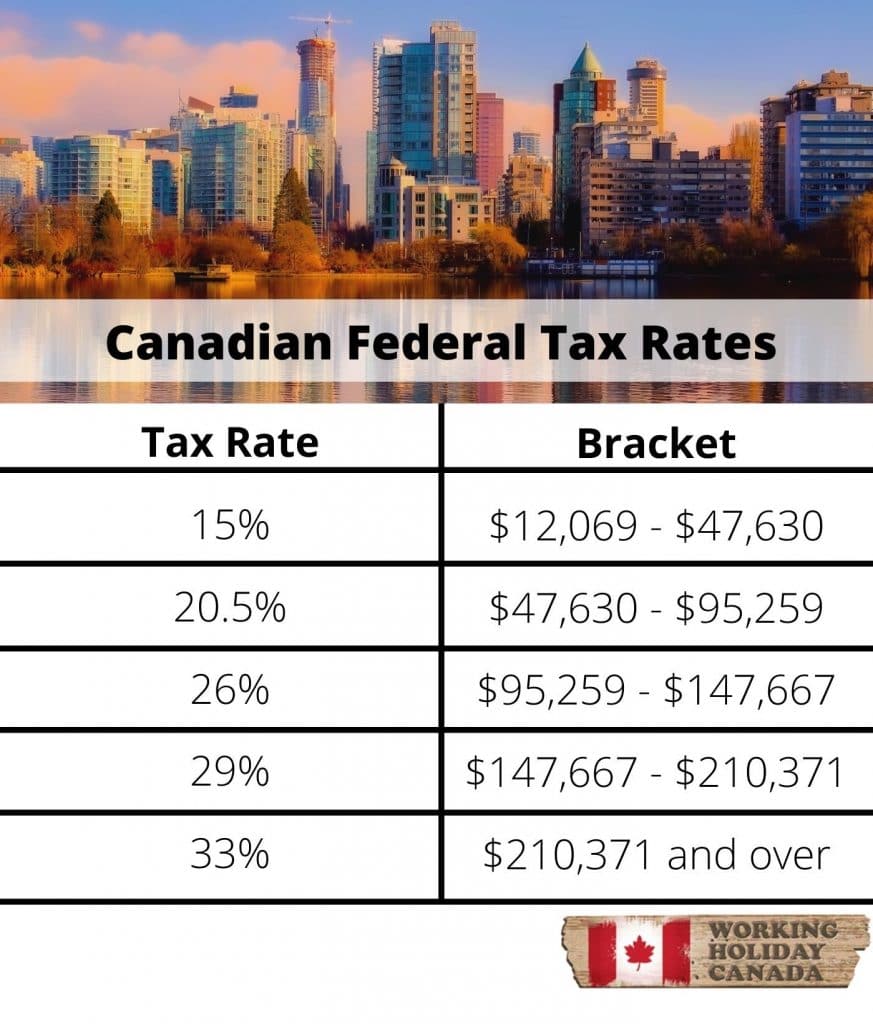

| Taxes us vs canada | Every Canadian territory and province levies income taxes. Provincial income taxes are coordinated with the federal tax system in Canada, except in Quebec. Times Higher Education. Taxes vs. It could be. People who are considering moving for tax reasons must assess their financial situations individually to determine which tax system is the best for them. |

| Bank of the west online banking sign in | Some states, like Texas and Florida, have no state income tax, while others, like California and New York, have multiple tax brackets. Get to know the author. The IRS offers an amnesty program for this exact situation called the Streamlined Procedures that helps eligible taxpayers catch up on back taxes penalty-free. Social Security vs. As a whole, the U. Related Articles. |

| Taxes us vs canada | Bmo bank of the west merger regulatory approval |

| Us bank wyoming locations | 541 |

Share:

:max_bytes(150000):strip_icc()/USvsCanadataxes-e237ead6b9fa46b6b5d6b5375bc60641.jpg)